A flurry of developments in late January 2025 has caused quite a buzz in the AI world. On January 20, DeepSeek released a new open-source AI model called R1 and

From DeepSeek to Distillation: Protecting IP In An AI World

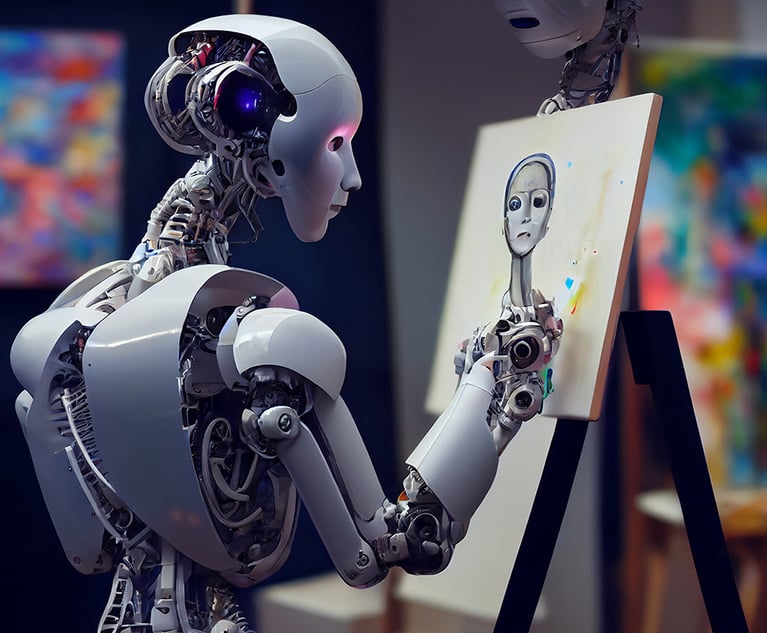

Protection against unauthorized model distillation is an emerging issue within the longstanding theme of safeguarding intellectual property. This article examines the legal protections available under the current legal framework and explore why patents may serve as a crucial safeguard against unauthorized distillation.

This premium content is locked for LawJournalNewsletters subscribers only

ENJOY UNLIMITED ACCESS TO THE SINGLE SOURCE OF OBJECTIVE LEGAL ANALYSIS, PRACTICAL INSIGHTS, AND NEWS IN LawJournalNewsletters

- Stay current on the latest information, rulings, regulations, and trends

- Includes practical, must-have information on copyrights, royalties, AI, and more

- Tap into expert guidance from top entertainment lawyers and experts

Already have an account? Sign In Now

For enterprise-wide or corporate access, please contact Customer Service at [email protected] or call 1-877-256-2473.